A: Assuming you have met the work-related eligibility requirements, you may begin enrollment into Medicare 90 days in advance of the month you turn 65.

A: Short Answer: Both Medicare supplement insurance and Medicare Advantage plans are coverage options for Medicare enrollees. However, the terms of applying/enrolling and coverage differ between the two, and it is important to understand the differences.

More Details:

Medicare supplement insurance Plans:

Medicare Advantage Plans:

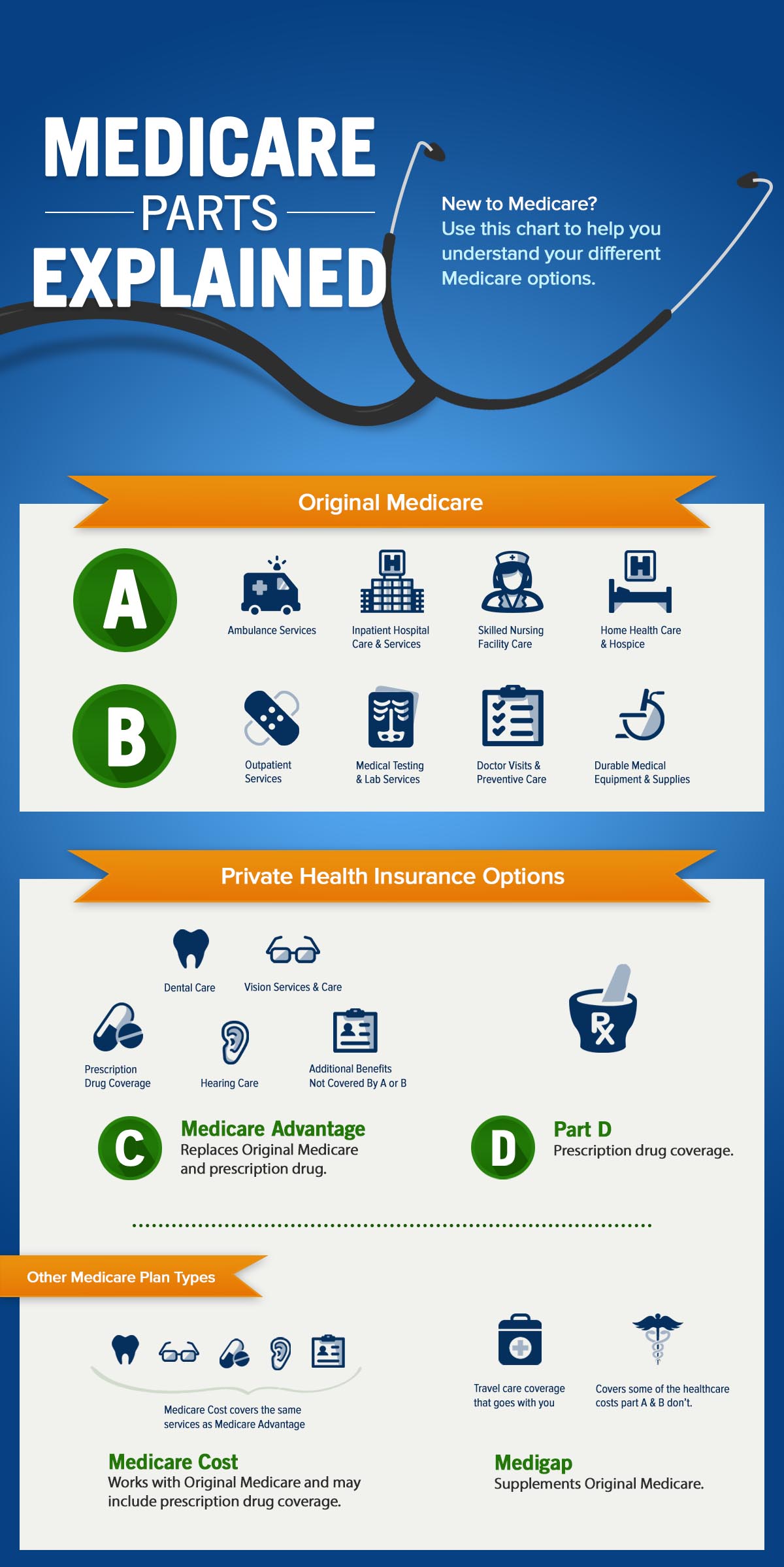

A: Medicare is divided into separate parts (Part A, Part B, Part C, Part D). Medicare Parts A and B are handled through the government. Medicare Part C is another name for Medicare Advantage, which is optional insurance you can get through an insurance company. Medicare Part D is the drug coverage portion of Medicare.

Because Medicare supplement insurance plans are standardized by the government, a specific plan, like Medicare supplement Plan F, will offer the same basic benefits no matter what company you purchase it from. Some companies may introduce small additional features like gym memberships, but all health care benefits are the same. These additional features are not insurance benefits. Even though the supplement plans are standardized, there are many different types of Medicare supplement plans available to you (Plan A through Plan N).

No. You cannot have both at the same time.

A: Yes. However, you will not have prescription coverage, and you will face unlimited financial exposure for medical and drug costs due to the gaps in Original Medicare. You will also incur a lifelong penalty for not having creditable drug coverage.

A: Original Medicare does not cover outpatient prescription drugs. If you do not have creditable prescription coverage through an employer/union, you will need to purchase Part D coverage from a private insurance company. If you have/want a Medicare supplement insurance plan you will need to purchase a standalone Prescription Drug Plan to cover your prescriptions. While many Medicare Advantage Plans include Part D Prescription coverage within the plan.

It is important to always either have creditable coverage or a Part D plan once you turn 65. If you are covered under an employer or spouse’s/partner’s employer plan, you will be notified if what you have is creditable coverage. If you will not have creditable coverage upon turning 65, you should enroll in a Part D plan. Skipping Part D enrollment means you will need to pay a lifetime monthly penalty if you ever do decide to enroll in Part D.

A: You usually can. It’s important to be sure your doctor accepts Medicare. Some don’t. All the various companies have different networks of physicians and hospitals they work with. We check plan networks and will advise you if they are or aren’t included in network.

A: No, it does not. Custodial care is never covered by Medicare and is only covered under a Long Term Care policy. Skilled nursing facilities are covered for short term care after an inpatient stay in the hospital. There is be improvement of the patient in order for that to be covered.

A: Original Medicare doesn’t pay vision, dental, or hearing benefits unless they are related to a larger medical occurrence. Generally, Medicare supplement insurance plans do not offer these benefits, either. Medicare Advantage plans might contain vision, dental, or hearing benefits.

A: Medicare does not have spousal or dependent coverage. Medicare is individual. If your spouse has reached age eligibility (65), then they can enroll in Medicare of their own accord 90 days in advance of the month they turn 65.

A: Maybe. If the employer group has 20 employees or more, and you’re going to continue to work, then yes, it’s an option. But there are many things to consider.

A: No, a retiree plan will typically wrap around Medicare primary benefits.

A: In addition to having a huge gap in coverage, you will likely face a penalty from Medicare. A Part “B” penalty can be 10% of your Part “B” premium for each 12-month period outside of Medicare, and up to 1% of the national average of a Part “D” plan for each month absent Part “D”.

A: If you move to a new state or have a seasonal retreat, your Medigap plan will usually travel with you, even if that plan is not sold in the other state. It’s best to check with your insurance agent to make sure your Medigap coverage will travel with you wherever you go. If you are on a Medicare Advantage Plan however, moving between states or counties could put you outside of the plan service area and you may have eligibly for a special enrollment period in order to get a new plan in your new area.

You cannot always change your coverage, so it’s important to be confident in your choice. Doing research up front and understanding your plan are excellent ways to help ensure the coverage you choose is right for you.

Many people decide to either purchase a Medicare supplement insurance plan in addition to Medicare Part A and Part B or to enroll in a Medicare Advantage plan.

Medicare supplement insurance plans are required to accept people who are in their Initial Enrollment period that last for 7 months (3 months prior to your 65th birthday, your birthday month, and 3 months after the month you turn 65). After that, you may be denied coverage due to health conditions, unless you have a qualifying status change.

Medicare Advantage plans, on the other hand, are required to accept anyone in their Initial Enrollment Period and anyone who applies during the Annual Enrollment Period from October 15 to December 7 of each year.

There are also Special Election Periods, SEPs, that may allow you to join a plan outside of your Initial Enrollment Period and the Annual Enrollment Period. Certain qualifying events include:

Didn’t find an answer to the question you were looking for? Please give Dominic Bagnoli a call, he would be happy to help you.

Contact information:

**We do not offer every plan available in your area. Please contact medicare.gov or 1-800-MEDICARE to get information on all your options.

Contact Us

Maconachy Stradley Insurance HQ

3205 Bretton St NW # 100

North Canton, OH 44720

Akron Office

3200 W Market St. Suite 301

Fairlawn OH 44333

Phone Number

1-330-966-5170

Email Address

[email protected]

Personal and Business Insurance for Canton & Akron Ohio

Copyright © 2016 Maconachy Stradley Insurance | All Rights Reserved | Web design by Joshua Paul Design